Nordic Notes - Issue #49

30. October 2022

Hey all,

Quite a few funding rounds to report this week & a cool data dump from the Baltic Startup Scene report in the Opinion section. Enjoy!

As always, happy to hear from you, let me know what I missed, what I can improve & what you’d like to read about!

Funding rounds

🇩🇰 Henlez raised 1m€ to transform the care of dermatological disorders.

🇳🇴 Ludenso raised 1m$ to build an augmented reality universe for education.

🇩🇰 Ztlment raised 1.3m€ for their smart contract software.

🇫🇮 Makea Games raised 1.3m€ for tools enabling gamers to build own games.

🇫🇮 Hyperion Robotics raised 3m€ to print sustainable concrete.

🇩🇰 All Gravy raised 3.2m€ to improve employee financial wellbeing.

🇸🇪 Stilride raised 3.6$ for their electric scooters and motorbikes.

🇸🇪 Grafbase raised 5m$ for their data platform for developers.

🇸🇪 Paebbl raised 8m€ to make industrial raw materials out of captured carbon.

🇫🇮 Bob W raised 21m€ for their tech-driven hospitality provider.

Did I miss something - send me a note!

Quick Notes

Norrsken announced that instead of one CEO, they now have two.

I loved reading the comments on this twitter thread on why VC’s shouldn’t be paid.

Opinion

This week I read through the Baltic Startup Scene report so that you don’t have to, even though I do recommend you to at least scroll through as it is full of interesting data. The whole report is a little under 150 pages long, so if you want to go through it I would recommend reserving a good amount of time for that. You can access a short overview here, a mini report here and the whole report here.

Key points from the report:

amount of startups is growing

popular industries: fintech, enterprise software & marketing

VC funding in the area has increased

seed to further funding stages success rate is lower than EU peers

I really love that they had a lot of data points that I haven’t typically seen in ecosystem reports, such as how many attempts it took for startups to receive VC funding. I would love to know if there’s any difference if you look at the team gender composition. It would also be super interesting to understand the fundraising strategies startups use, or how many startups even think about their fundraising strategy.

The average round sizes in the region have been growing, but are still quite low when comparing with European averages.

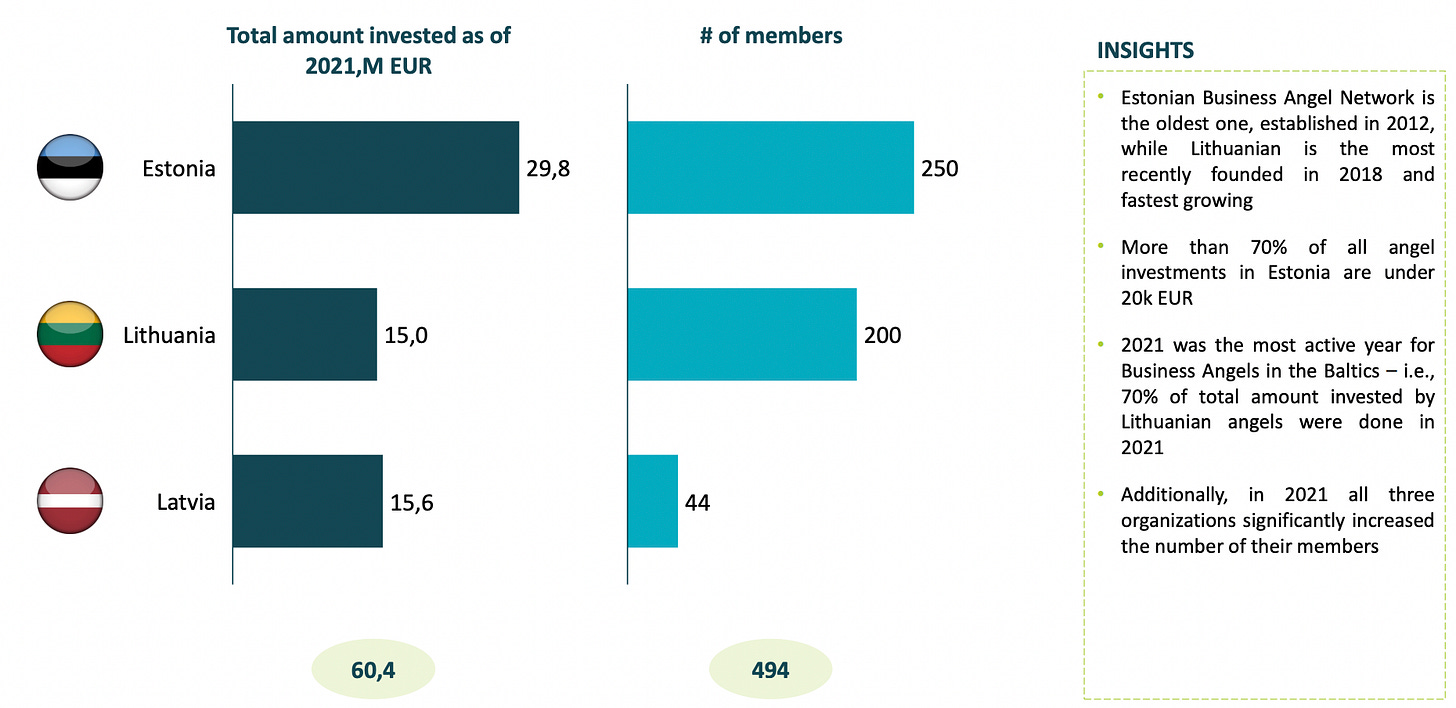

Especially the Estonian angel investors seem to be super active according to the data. What’s interesting though is that the ticket sizes are quite small (not a bad thing imo), with 70% of angel investments being under 20k€.

There’s even a more detailed list of angels investing in the area or maybe you could also call it a leaderboard (p.33).

That’s all the highlights I wanted to share - go explore!

Laughs today brought to you by central banks & governments

All the best,

Josefiina