Nordic Notes - Issue #11

26. September - Fund launches, SOET & deal data

Hey all,

It’s been a while and a lot has happened in two weeks. I had a great time hiking in the woods, but the tech world definitely does not stop in September. So there was a lot of catching up to do after a few days of no reception. And sooooooo many fund launches 💰💰💰

As always, happy to hear from you, let me know what I missed, what I can improve & what you’d like to read about!

Funding rounds

🇫🇮 StemSight raised 500k€ for curing blindness using stem cells.

🇸🇪 Circulate raised 1.3m€ for their sustainable packaging marketplace.

🇫🇮 Book Salon raised 1m€ for their beauty focused payment and booking service.

🇸🇪 Lunch.Co raised 500k€ for their peer-to-peer lunch app.

🇮🇸 Monerium raised 4m$ for their DeFi solution.

🇸🇪 Tracklib raised 12.2m$ for their music sampling platform.

🇫🇮 Meru Health raised 38m$ for their mental health focused online platform.

🇸🇪 Doconomy raised 14.5m€ for their impact focused financial processing services.

🇫🇮 Elfys raised 3m€ for their photodetector.

🇱🇹 Kernolab raised 1m$ for their startup doing banking-as-a-service.

Did I miss something - send me a note!

Quick Notes

Revaia launched a 250m€ growth fund and is Europe’s largest female founded VC fund.

Yes VC launched their second fund.

Vendep Capital announced the first closing of their third fund. Ps. they’re also looking for a platform and marketing director.

Nexit Ventures launched their newest fund with a target size of 150m€.

Tesi (Finnish Industry Investment Ltd.) is looking for trainees.

Antler launched in Copenhagen.

Not sure if it was a fund launch or an announcement of changing positions, but regardless Benjamin Ratz is now COO at foobar.vc.

Heartcore launched their new fund Heartcore IV at 200m$ and a 50m$ opportunity fund.

Applications for Included VC are open.

Longer Notes

🥳 We launched our new 100m€ fund at Maki.vc. It’s been a great journey thus far, in early 2018 we were just four people with a first close done looking forward to launch a new fund and now were already investing from our second fund with ten people in the team. Time flies by when you’re having fun!

The State of European Tech questionnaire is here again! Please contribute & share the word, it’s definitely one of my favourite sources when looking for yearly data on the European tech scene.

Opinion

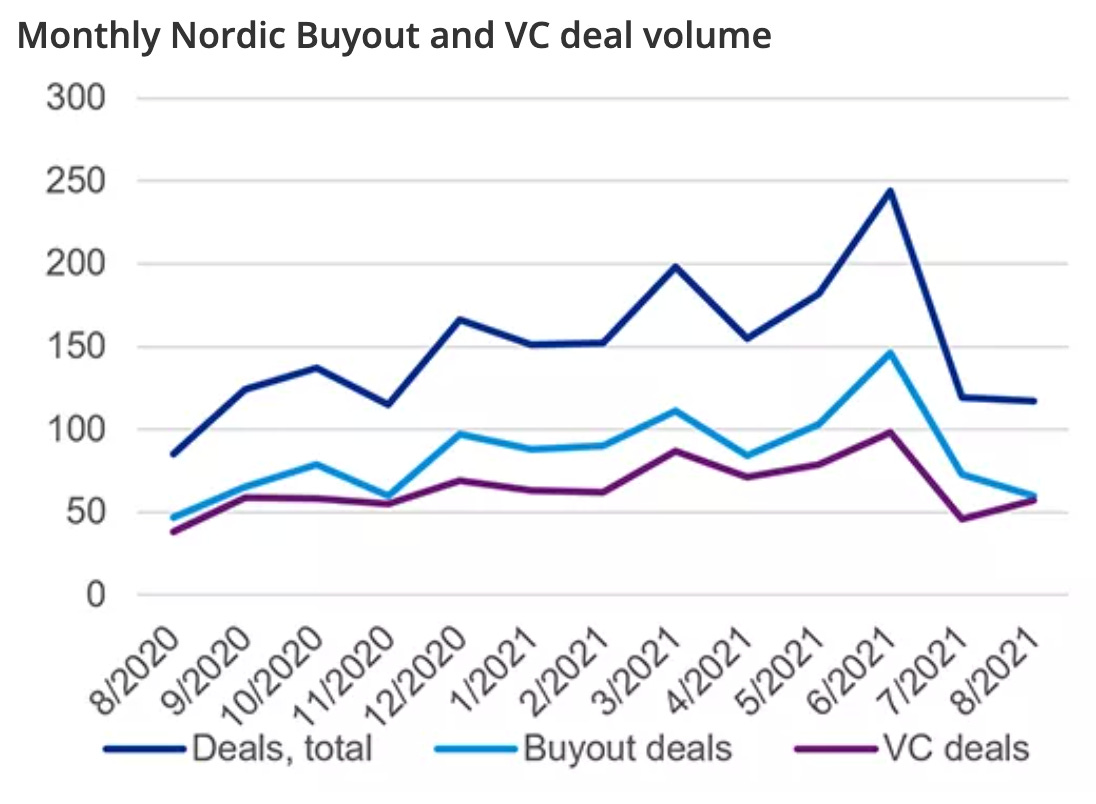

KPMG published some deal data recently, so I thought I’d share some thoughts that arose from going through it. First we have a regular deal volume graph. The number of deals hasn’t quite picked up to the levels of before summer yet, but hopefully we’ll get there. At least there’s been many fund launches recently so the amount of funding available hopefully isn’t the bottleneck here.

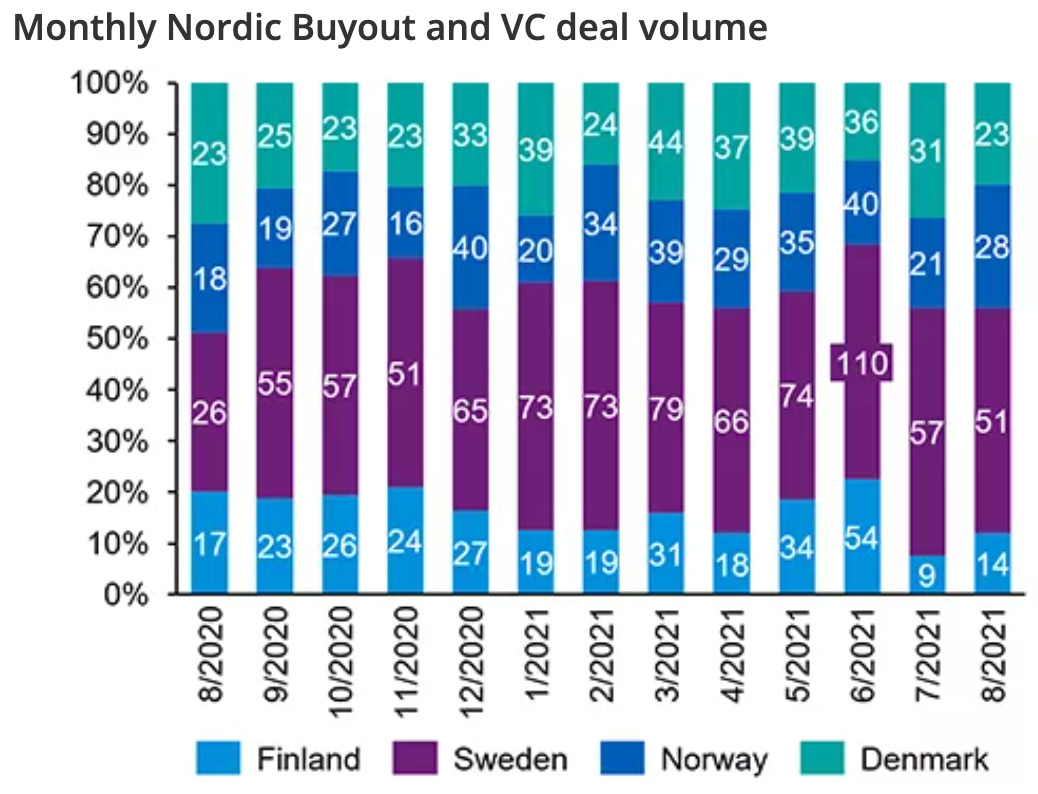

From the second graph, we’ve got to note that it includes both Buyout and VC deals. Sweden is consistently the largest chunk in the mix, most likely anyways even if buyout data was taken out. Surprisingly, Finland is lagging quite a bit in the last two months compared to Sweden and Norway.

And as we’re talking about how great it is that there’s a good number of deals made and the quick notes section has a long list of new dry powder in the Nordics, I wanted to introduce a great tweet by Ian. Ian here works for Greycroft and is based in New York, so I’m guessing the data from his tweet refers to the US market. Regardless he has a point.

I’ve raised the topic of early stage funding (angel & pre-seed) previously, but have not yet given much thought to the other end of the spectrum. Hopefully food for thought for your Monday.

All the best,

Josefiina